Why Most Startups Go Broke? In the glittering world of startups, where innovation promises to disrupt industries and founders envision meteoric success, there’s a well-known truth: 90% of startups fail, and 38% cite running out of cash as the primary reason. Let that sink in. It’s not a lack of creativity, hard work, or even market opportunity; it’s cold, hard financial mismanagement.

How Financial Literacy Mistakes You’re Making

Startups don’t fail because their ideas aren’t brilliant; they fail because their founders didn’t know how to make their money work for them. Financial literacy isn’t just a skill for accountants; it’s the lifeblood of your entrepreneurial journey. If your startup’s finances aren’t rock-solid, no amount of genius will save you. Let’s uncover the hidden financial literacy mistakes silently sabotaging most startups and, more importantly, how to fix them before it’s too late.

Mistake #1: Confusing Revenue with Profit

What’s the Problem?

Many founders get seduced by flashy numbers. Revenue streams come pouring in, and success is inevitable. But here’s the kicker: revenue doesn’t mean anything if your expenses are bleeding you dry.

You could generate six or even seven figures annually, but if your operational costs, marketing spend, and founder withdrawals are eating away at every dollar, you’re not growing; you’re dying slowly.

How to Fix It

- Track Gross vs. Net Profit Religiously: Use tools like QuickBooks or Wave to track your financials. Know exactly what’s coming in and going out.

- Understand Burn Rate: Calculate how much money your startup spends monthly and how long you can sustain it before running out of funds. A high burn rate with no plan for profit equals disaster.

- Reinvest Strategically: Allocate profits into growth areas like customer acquisition or R&D, but always leave a buffer for unexpected downturns.

Mistake #2: Scaling Too Quickly Without Financial Backing

What’s the Problem?

The startup playbook glamorizes the rapid scaling of more team members, a swanky office, and aggressive ad campaigns. However, scaling too quickly without a stable financial foundation is a typical death sentence.

Imagine a balloon inflating faster than it can handle; it bursts under pressure. That’s your startup when you overextend without sufficient cash reserves or a proven, repeatable revenue model.

How to Fix It

- Master MVP Economics: Perfect your Minimum Viable Product (MVP) before chasing expansion. If your MVP can’t sustain itself, scaling will only magnify your losses.

- Keep Fixed Costs Low: Initially, hire contractors instead of full-time employees. Leverage co-working spaces instead of expensive leases.

- Track ROI on Every Dollar: Whether it’s marketing campaigns or software tools, ensure every dollar spent delivers measurable value.

Mistake #3: Ignoring Cash Flow Management

What’s the Problem?

Your startup can have customers, solid products, and great marketing, but it will still collapse if cash flow isn’t managed. Cash flow mismanagement is like breathing with a blocked airway: even if your body is healthy, it won’t survive long.

You might find yourself with delayed invoices or tying up cash in inventory, leaving you unable to pay vendors, staff, or rent.

How to Fix It

- Adopt a Rolling Cash Flow Forecast: This means projecting your cash inflows and outflows for the next 6-12 months. It’s not optional; it’s survival.

- Automate Invoicing and Collections: Late invoices kill startups. Use tools like Xero or FreshBooks to send automated reminders and track payments.

- Build a Cash Cushion: Aim to have at least 3-6 months of operating expenses saved as a buffer.

Mistake #4: Overlooking Unit Economics

What’s the Problem?

If you don’t know how much it costs to acquire and serve one customer, you’re flying blind. Startups often fall into the trap of pouring money into customer acquisition without understanding whether those customers are even profitable in the long term.

How to Fix It

What is Customer Acquisition Cost

- Calculate CAC (Customer Acquisition Cost): Add up all marketing and sales expenses, then divide by the number of customers acquired during that period.

- Determine LTV (Customer Lifetime Value): Measure the total revenue a customer generates throughout their relationship with your business.

- Compare the Two: Your LTV should be at least 3x of your CAC. If it’s not, you’re burning money instead of making it.

Mistake #5: Avoiding Financial Education

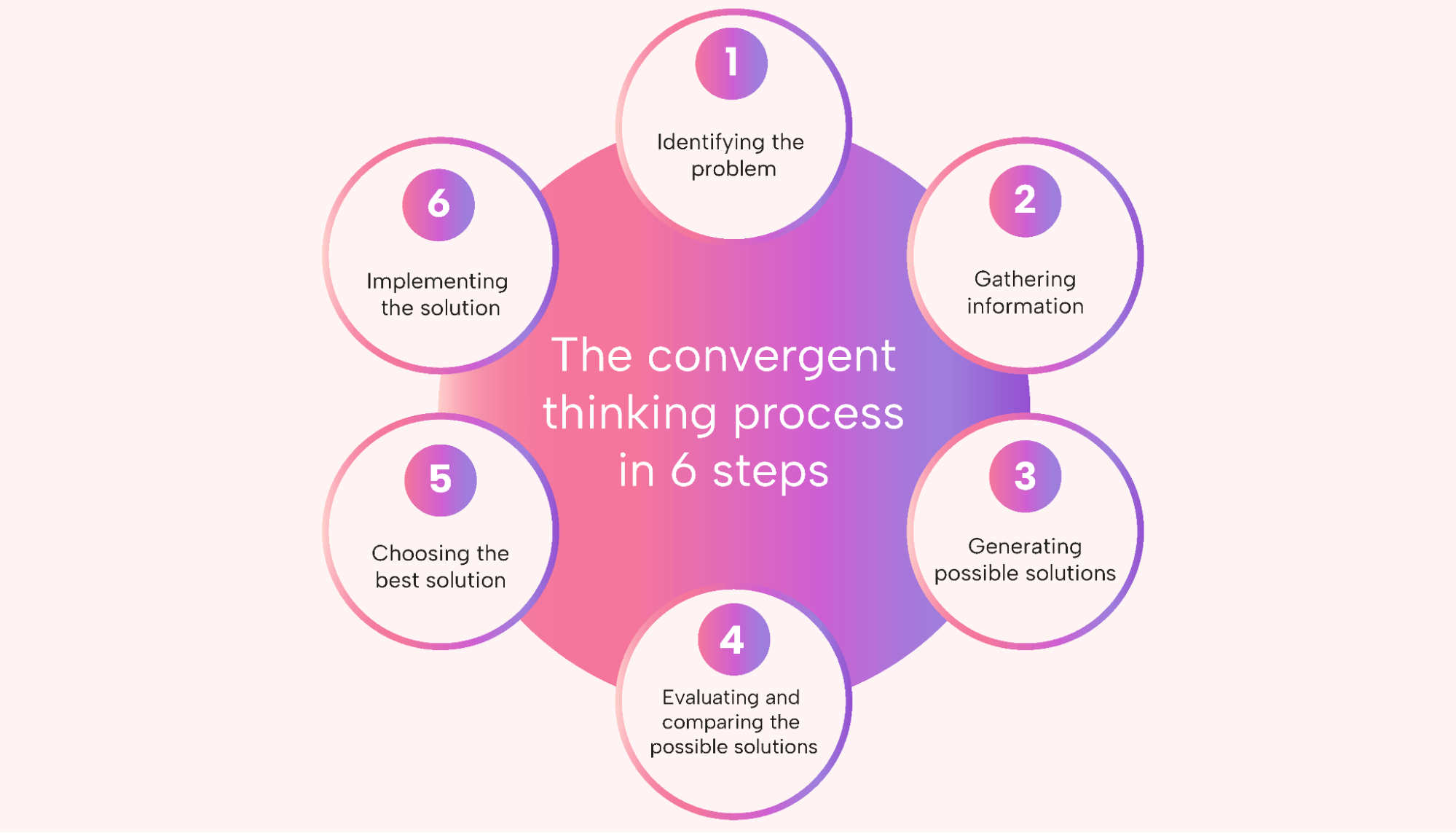

What’s the Problem?

Too many entrepreneurs think financial literacy is someone else’s job. You hire an accountant or CFO or outsource to a bookkeeping service, assuming they’ll handle the numbers. Here’s the harsh reality: if you don’t understand your finances, you do not control your business.

How to Fix It

- Learn the Basics: Take an online course in financial literacy for startups. Platforms like Coursera, Skillshare, and Udemy offer practical budgeting, cash flow, and economic forecasting courses.

- Schedule Financial Reviews: Sit down every month to review your financial statements. Understand your P&L (Profit & Loss), cash flow statement, and balance sheet.

- Surround Yourself with Experts: Hire advisors or mentors with financial expertise who can challenge your assumptions and provide guidance.

Mistake #6: Underestimating the Power of Tax Strategy

What’s the Problem?

Taxes are often an afterthought for startups. However, neglecting tax strategy can result in hefty penalties, lost deductions, and cash flow issues that stunt growth.

How to Fix It

- Claim All Deductions: Know what qualifies, such as startup costs, home office expenses, software subscriptions, and even travel.

- Set Aside Tax Money Monthly: Avoid a year-end scramble by allocating a percentage of your revenue to a separate tax account.

- Leverage Tax Advisors: Hire a tax professional who understands small businesses and can help you navigate complex tax codes while maximizing deductions.

Mistake #7: Thinking Funding Solves Everything

What’s the Problem?

Securing funding is often seen as the ultimate goal for startups. But here’s the truth: money doesn’t fix bad financial habits. Venture capital or loans can amplify problems if you don’t have the financial discipline to manage them.

How to Fix It

- Bootstrap Wisely: Before seeking funding, prove your business model works with minimal resources.

- Have a Funding Plan: Know exactly how much you need, what you’ll use it for, and how it’ll generate ROI.

- Stay Accountable: Treat investor money as a responsibility, not free cash to spend frivolously.

Take Control of Your Startup’s Financial Destiny

Startups thrive on bold ideas, but success is rooted in sound financial management. By addressing these common mistakes; confusing revenue with profit, scaling too quickly, ignoring cash flow, neglecting unit economics, and bypassing financial education; you set your business up for sustainable growth.

Financial literacy isn’t just a skill; it’s your startup’s survival strategy. Treat every dollar as a tool to build your vision. Start today because the sooner you take control of your finances, the closer you’ll be to joining the 10% of startups that succeed.